Finally, the simulated prices are used to price arithmetic average options and to estimate the implied volatility of the options. Secondly, the characteristics of simulated prices are compared between the models. Firstly, two types of models are calibrated based on historical data on oil prices during the period 2012-2017. This is achieved by following several steps.

The aim of the present study is to examine how stochastic models can be used to model oil prices. This may be especially important in the context of the 2014 drop in oil prices. It could be useful to explore commonly employed models with regards to commodity markets.

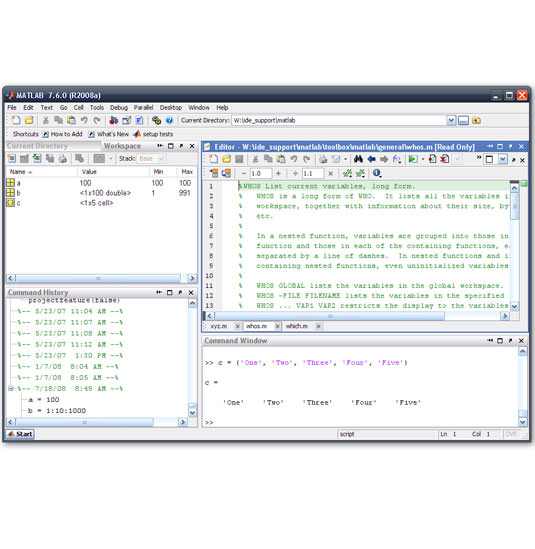

#Matlab 2012 price series#

These techniques account for the observed characteristics of financial series such as mean-reversion and large jumps. Numerous techniques have been proposed to model volatility. Furthermore, it is used to price financial assets such as exotic derivatives. It is crucial for understanding the behaviour of prices and spillover effects.

Market volatility has received great attention in academic literature.

The MRJD model reproduces volatility smiles for the arithmetic average options showing that lower volatility is associated with the at-the-money options. This can be explained by the potential existence of two distinct regimes of the oil price behaviour associated with the 2014 drop in oil prices. Based on the results, no substantial difference has been found between the simulated prices due to the slow speed of mean reversion and low jump intensity estimated for the MRJD model. The Geometric Brownian Motion (GBM) and Mean-Reversion Jump Diffusion (MRJD) models are used for this purpose. This study focuses on the modelling of oil price behaviour during the period 2012-2017.

0 kommentar(er)

0 kommentar(er)